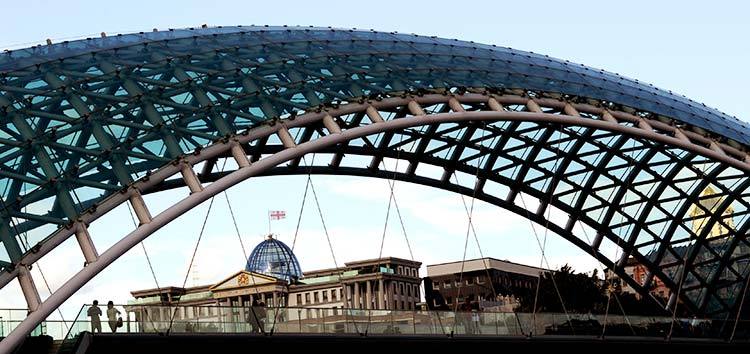

Energy Sector Overview – 2020

Institute for Development Freedom of Information (IDFI) has overviewed the current developments and challenges in the energy sector of Georgia as of 2020.

IDFI launched the periodic review of the energy sector in 2020, and the current review provides the full state of 2020 in terms of generation and consumption dynamics, electricity trading trends, electricity retail and wholesale prices, and planned and ongoing changes in the sector, as well as forecasts: generation, consumption, and deficit in the coming years.

Key Findings: Energy Sector Decreases

– Electricity generation was down by 5.9% YoY during 2020. Generation from TPPs was broadly unchanged (-0.7% YoY), but generation from renewable sources was down considerably (-7.7% YoY) over the same period.

– COVID-19 pandemic sharply reduced electricity consumption (-10.3% YoY) in 2020. This is largely explained by decreased economic activity, reduced consumption of large crypto manufacturers, and mostly the absence of tourism. Electricity consumption was down by -5.7% YoY in the same period, despite the growing electricity consumption in Abkhazia.

– Consumption of Abkhazia reached 93% of Enguri HPP generation in 2020, and per capita consumption in Abkhazia is 3.3 times higher than in the rest of Georgia. Electricity consumption in Abkhazia displayed high growth (+24% YoY) and reached an all-time high (2.5 TWh) during the same period. Decreased generation from Enguri HPP also contributed to the increased share of Abkhazia in 2020.

– Electricity net imports were worth USD 59 mln in 2020.Slightly less compared to the last year (USD -11 mln), mainly at the expense of lowering the import price of electricity, which, on average, was 4 USD cents in 2020 (-17% YoY). Electricity imports from Russia were at a recordhigh for the four years, accounting for 35% of total imports,partially to balance the increasing consumption needs of Abkhazia.

– Increased wholesale prices on electricity for consumer and commercial customers.The increase is highest (+24%) for household customers with consumption below 102 kWh, as well as for commercial customers represented in the region (+ 90%).

– FDI in the energy sector decreased four times during the 9m of 2020 as compared to the same period in 2019, amounting to $46 million.TheCOVID-19 pandemic played an important role in the reduction in FDI, but it should be mentioned that against the background of the depreciation of the GEL exchange rate, there are currently no sufficient incentives to promote investment in renewable energy, which could attract FDI in the energy sector and reduce Georgia’s dependence on imported electricity.

– Starting the operation of the Georgian Energy Exchange is a step towards market liberalization.The functioning of the exchange should facilitate the formation of market prices in the sector, which will have a positive impact on the investment environment and send the right signals to market participants.

– Electricity consumption is expected to increase to 12.6 TWh this year, which is less than the 2019 level (12.8 TWh). The total generation is expected to be 11.5 TWh (taking into account the ongoing works on the Enguri) during this period, and the deficit will reach 1.6 TWh, which may be offset by an increase in imports or generation of thermal power plants.

Recommendations

– Mechanisms for attracting investment by the government were not developed in 2020, and this has hindered the addition of new generation sources, as well as having a negative effect on economic growth.

Currently, after the abolition of PPAs, there are no mechanisms that could guarantee investors a minimum tariff, hedge FX risks, and promote investment in renewable energy. It is important to develop feed-in tariff or other appropriate mechanisms that could serve this role.

– The functioning of the energy exchange is important for the development of free-market mechanisms and will contribute to the growth of the country’s energy independence and the security and safety of electricity supply.

Higher imports from neighboring countries decrease energy independence. Marketderegulation will improvethe investment environment in the sector. In case of price increases, socially vulnerableconsumers should be subsidized directly.

– It is essential to promote renewable energy for households and micro-enterprises by introducing tax incentives and energy-efficient (subsidized) loans.

GNERC introduced mechanisms that support the integration of micropower plants in the grid, but considering the high cost of the technology, the government should introduce tax incentives (VAT exclusion for renewable energy technology) or energy-efficient loans that would promote the development of renewable technology.

– Develop a long-term strategy for the sector that will focus on increasing energy efficiency and promoting renewable energy in the country.

Currently, there is no long-term strategy that would define strategically important projects for the country, support their implementation,and project sector development scenarios.