Georgia and IMF Conclude Staff-level Agreement on a three-year US$289 million Stand-By Arrangement

April 1, 2022End-of-Mission press releases include statements of IMF staff teams that convey preliminary findings after a visit to a country. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF’s Executive Board for discussion and decision.

- The Fund-supported arrangement is subject to approval by the IMF Executive Board, which is expected to consider it in May 2022.

- The authorities’ program would help Georgia maintain and further entrench macroeconomic and financial stability amidst back-to-back shocks and achieve stronger and more inclusive growth.

- The Stand-By Arrangement supports the authorities’ comprehensive economic reform program.

Washington, DC: At the request of the Georgian authorities, an International Monetary Fund (IMF) team led by Mr. James John held virtual meetings with Georgian officials between November 18, 2021 and March 31, 2022 to discuss a three-year economic program that could be supported by the IMF under a Stand-By Arrangement (SBA).

At the conclusion of the mission, Mr. John issued the following statement:

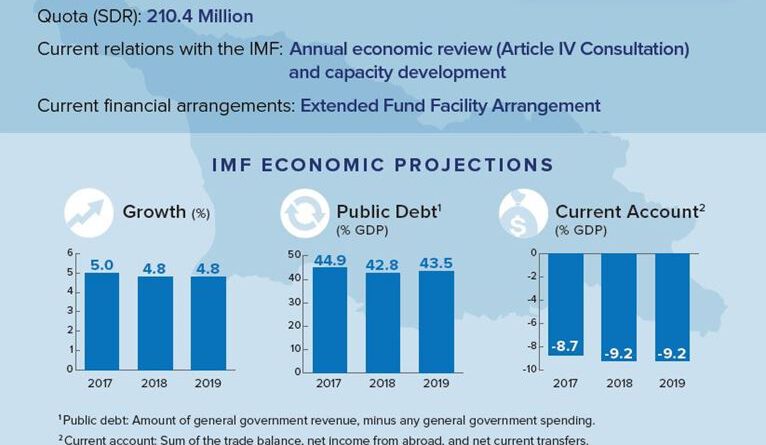

“I am pleased to announce that the IMF team has reached a staff-level agreement with the Georgian authorities on a three-year Stand-by Arrangement (SBA) in the amount of SDR210.4 million (about $289 million) or 100 percent of Georgia’s quota. The agreement is subject to approval by the IMF’s Executive Board, which is expected to consider Georgia’s request in May.

“Georgia’s economy was enjoying a strong recovery from the COVID-19 pandemic—growth reached 10.4 percent in 2021—before the Russian invasion of Ukraine. Spillovers from the war and sanctions are expected to lower Georgia’s growth to around 3 percent in 2022, raise inflation, and widen the current account deficit. The outlook is subject to a higher-than-usual level of uncertainty. Georgia’s economy has proven resilient in the past, and with the support of policies under the authorities’ program, we expect growth to pick up in 2023 and other key indicators to strengthen as well.

“The authorities’ program aims to maintain and further entrench macroeconomic stability in the context of back-to-back shocks from the pandemic and the war in Ukraine, strengthen medium-term growth, and enhance economic resilience.

“After substantial pandemic support, fiscal policies are geared toward reducing the deficit to comply with the fiscal rule by 2023, restoring fiscal buffers, and creating space for priorities such as infrastructure and education. Should spillovers from the war such as elevated global commodity prices prove more severe than expected, targeted measures to help the vulnerable could be considered within the budget envelope. The program will also seek to improve public financial management and limit fiscal risks, especially through finalization and implementation of a strategy to enhance governance of state-owned enterprises.

“Several global shocks have contributed to inflation that is well above target in Georgia. The National Bank of Georgia continues to be appropriately focused on bringing inflation to target and we expect significant progress this year and next as global factors that are contributing to the surge in prices subside. The inflation targeting framework combined with the flexible exchange rate regime has served Georgia well. The authorities are committed to exchange rate flexibility, which acts as a shock absorber, and interventions will be limited to smoothing excessive volatility and preventing disorderly market conditions.

“Georgia’s financial sector has shown considerable resilience to the pandemic and the war in Ukraine, reflecting a robust supervisory and regulatory framework including the introduction and recalibration of macroprudential measures. Quick and appropriate NBG action has helped limit the impact of the war, including by requiring banks to adhere to relevant sanctions. Financial sector policies will be further strengthened in a number of areas such as supervision, the prompt corrective action framework, and large exposures, following up on recommendations from the recent IMF-World Bank Financial Sector Assessment Program. Sustained strong macroeconomic and financial sector policies should also help reduce still high dollarization and related vulnerabilities over time.

“To strengthen growth and make it more inclusive, the authorities’ structural reform priorities focus on education and training to tackle high unemployment and address labor market mismatches, and on upgrading the country’s infrastructure. Actions in these areas will improve the business environment, foster regional integration, and enhance the country’s potential as a transportation and logistics hub.

“During the visit, the team met with Governor of the National Bank of Georgia Mr. Gvenetadze, Minister of Finance Mr. Khutsishvili, Minister of Economy and Sustainable Development Mr. Davitashvili and his predecessor Ms. Turnava, and other senior government officials, as well as with representatives of Georgia’s international development partners, civil society, and the banking and business communities.

“The IMF team would like to thank its counterparts for the open and constructive discussions and collaboration that have brought us to today’s successful conclusion.